Home prices are officially falling for the first time in over a decade. What happening in real estate ? We're going to look at why it's happening.

How quickly is this happening?

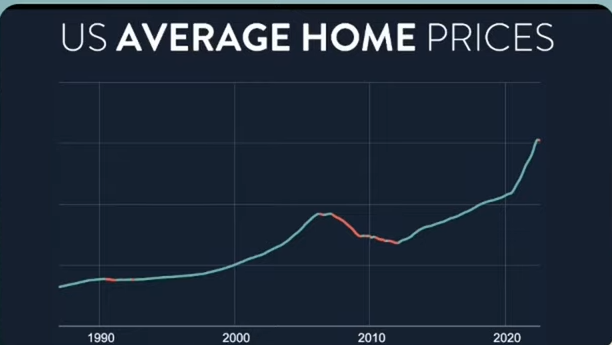

The weather is going to continue, and if it's a good time for you to buy a home, the U.S national home price index basically looks at the same home sales over the course of time. So when you build a new home sometimes, new homes are bigger than the existing homes so I can alter the average home price. This looks at the trend in same home sales, if you sell your home later if that price goes up and down and generally home prices go up.

As you can see all those green sections are months where the price increases and the red sections are

months where the price decreases and we haven't seen a month where the price has decreased, since the financial crisis real estate crash of 2007 to 2009. So We've had over 10 years of monthly increases in same home sales until just now when they released the most recent numbers and we saw our first ever decline in over a decade.

Why is this happening in real estate ?

Well in short a few reasons, one we're seeing big inflation which means rates are going up, you know the FED is Raising those rates to help curb that inflation when rates goes up that means, mortgage rates go up and when mortgage rates go up that means, your monthly expense goes up.

To buy a new home that means it lowers demand or lowers the amount that new home buyers can pay. Which means prices have less competition, which means home prices go down. So basically it's more expensive to get a mortgage, which means people who are selling a home don't have as much competition.

If we look at mortgage prices this is the mortgage prices since about the mid 1970s and so you can see back in the early 80s there's crazy they're up over 18 percent and we've had historically low mortgage prices for the last decade or so. But now they're shooting back up as rates go up and as they shoot back up you can see that steep increase in mortgage rates is correlating to this tiny little drop right there, if you can see it right there in home price sales.

Is this going to continue in real estate ?

I said you know no one knows the future. I can't tell you exactly What's going to happen? but you can see in those previous steep increases you know before 2007 we kind of saw a steep decline in prices and economies generally don't turn on a dime and the FED has made no indication that they're going to stop raising rates. So my prediction is yes the home price index is going to continue to decline probably for at least a year or if not more so I think we're going to see a lot more red over here from this little start.

I predict it's going to be sharp usually when there's like these star sharp shoot ups, there's also sharp declines that follow and I think that's probably what we're going to experience here. So that leads to the big question: Should you buy now ? And I'm sorry but you're gonna get the boring answer which is you're not gonna get rich by timing the real estate market.

I know it's human nature to want to make clever Financial moves based on what you see going on. You're like oh if I could only have bought thinner if I would have done this, and the reality is the way you're going to get rich is by buying less home.

Investing the difference living frugally, investing early and often over long periods of time.

If we look back at this chart, if you would have bought at The very Peak the day before you knew the decline of the housing crash started back in 2007 you would be fine today. You know the prices would go up 10 years later. If you were bought at the very bottom of the crash of 2009 or 2010, yeah you'd be slightly better off.

But this isn't how people get rich by buying a house there or there people get rich by investing early and often. So for example if you bought a house every two years and it's an investment property rather than your primary home, five or ten years later you'd own five properties and then you know when you bought each of those properties. it wouldn't matter a whole lot if you accumulating more properties is how you get rich. So if you're looking to buy your first home or switch homes, the exact moment you do, it isn't going to what makes you rich or not rich? What matters is you living freely ?

Here's a little chart that shows it. So if you are renting currently renting modesty is always going to beat buying luxuriously because homes have huge expenses associated with them there's mortgage interest and property tax and realtor fees and insurance and maintenance and remodels and inspections and new roofs and driveways and sidewalks and everything.

So if you're renting modestly and then you buy luxuriously you're going to be way wealthier if you continue renting, but the opposite is true too, if you buy modestly you can be way better off than.

If you rent luxuriously and it's important that you run the numbers you know if you live in a part of a town where you know home prices are crazy, high and rent's only kind of high renting might be better.

But if you live in a part of town where mortgage prices are super low and homes are super cheap and rent super high then you're probably better off buying.

But either way what you want to do is buy less home so while it may be very tempting to try to time. What seems to be this crazy real estate market that we may be entering it's not going to make you rich and if you want a home someone else is going to want a home too so there's never going to be a crazy steal on a new home there's just always going to be the same general principles of buying mostly renting modestly investing the difference.

If you want to be buying real estate, look at buying investment properties you know look for good deals of cash that have positive cash flow, you can buy investment property whether rent coming in outpaces all the expenses going out, if you can do that and accumulate them over time that's one good way that a lot of rich people get rich.

So while home prices are certainly falling right now it's not going to be an opportunity to suddenly get rich quick, but you know what is going to make you rich is by following the two rules of personal finance Club -

Post a Comment