Alright so we are going to see how to invest 500 per month and turn it into over 2.9 million dollars and so we're gonna break down a little bit.

About how that works ?

About why that works ?

About why you can turn this relatively modest amount of money monthly into millions of dollars over time and so by investing it.

I saw this is called a compound growth investing table.

I saw this in high school. It blew my mind and changed my life. I hope it changes your life too.

We're gonna break it down right now so this is that same example of saving 500 per month that that Amanda did which turned into 2.9 million dollars in your number one 500 times 12 months is

6 000

That's where the 6000 dollar number comes from right there. If you get a 10 percent rate of return on 6000 dollars.

Ten percent of 6000 is 600 right here and

6000 + 600 is 6600 so if you do this for one year you'll have 6600 bucks.

600 of which is growth. You know that's not bad, 6600 bucks a lot of money a year's worth of savings you've done well for yourself but it certainly isn't a life-changing amount of money.

But let's go forward in year number two you save that same 6000 dollars, 500 bucks a month.

So now but let's look at what happens now. So on that 6000 dollars you saved you get your 10 % rate of return which is 600 bucks but this doesn't say 600 because you also get paid again from the previous year's rate of return which is another 6000.

So this 6000 + 6000 is 12000 so actually you get 1200 bucks you get 10 percent on all this which is 1200 but look it doesn't say 1200 here either says 1260.

So where does that 60 come from? That 60 actually comes from the growth of last year's 600 here so remember last year 600 bucks.

Investment that growth is creating new growth

Now that it's part of your investment that growth is creating new growth and 10 of 600 is 60 which is where the 60 comes from and so that is the little c the little beginning of the magic of compound growth and so you can see after two years you have 13 860.

That's a pretty serious chunk of change after two years of saving. Most of that is still that twelve thousand dollars is what you put in, but now you know the 1860 here the extra is actually from the growth all right.

We're going to fast forward now we're going to go to year number 10 you're still saving 500 bucks a month but now look at your growth it's over 9 000 so only ten years in and if you're younger, if you're in your 30s you start to know that 10 years kind of goes in the blink of an eye. If you're 22 you might think that 10 years is a long time but trust me when you're 32 you're going to realize it went fast but just 10 years.

You now have 1,05,000 and more importantly the growth is actually more than what you put in, so what has happened here is this is a snowball effect it's called compound growth. Because the growth creates growth which creates growth and just 10 years in it's like a runaway snowball. where what you're saving the work you're doing, when you're going to work and saving the money and putting that money in that is actually less important at this point than the actual snowball effect of it just going, you know going on its own.

So you can actually stop investing now and this investment will continue to exponentially grow forever but let's fast forward one more time and go to year number 40. Look at that now you're getting 2,6,000 a year and if i get out of the way for the total of 2.9 million dollars.

Can you imagine this was started as just 600% of growth in your number one and your number 40 is 2,65,000 per year. How amazing.

That is how you retire early and become financially independent. You know your total investment is 2,40,000 and the final investment is 2.9 million dollars over 10 times more money, more like 12 times.

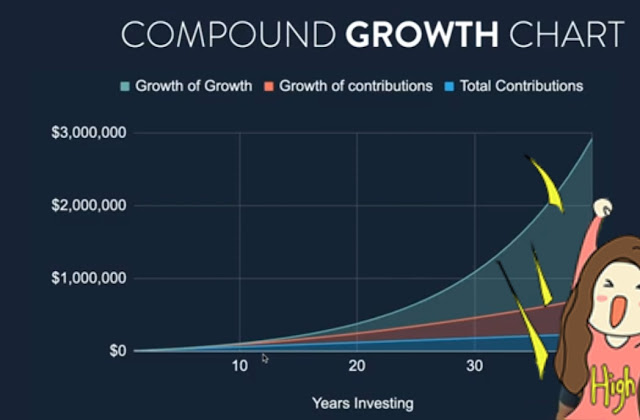

Chart analysis of compound growth of investment.

All right let's look at that as a chart so you can see here this blue amount here is that same cash under the mattress that's like how much money if you just saved it up and early.

It's a little bit hard to see because it's so small but, in the first 10 years most of the money is just from your savings but as time goes on this red line is actually the growth of what you save.

It's like those 600 bucks every year. You know your 600 bucks growth on your 6000, you can see that gets bigger and bigger over time because you're getting paid for all the previous years and then the screen is the growth of the growth. That's what starts at 60 bucks.

That little tiny c that's too small to even see back here, as time goes on it becomes the biggest portion in fact it's like you know over two-thirds whereas what you put in is less than 10 and so this shows the magic power of compound growth and why rule number two of building wealth is to invest early.

Often it would be great if I could just tell you the magic secret, the magic cryptocurrency, the magic NFT, some magic just become wealthy overnight but real wealthy people like myself and other millionaires invest over long periods of time. They start early and often and let compound growth do the work okay so we're still kind of in abstract land here.

Post a Comment